#Collaborative post

Everyone is aware that the current climate is not a good one to be in if you are trying to buy your first home or move home.

We have had so many discussions on our plans to move, we had a 5 year plan and a long term plan yet all of those have had to go on hold as the reality is, it just does not make financial sense for us to make a decision like that whilst the rates are so high and inflation even higher.

I consider us the lucky ones though, we already have our home and luckily 4 years left on a good mortgage deal, for others it is an uncertain time as rates rise and many first time buyers see their dream to buy their own home slip away for now.

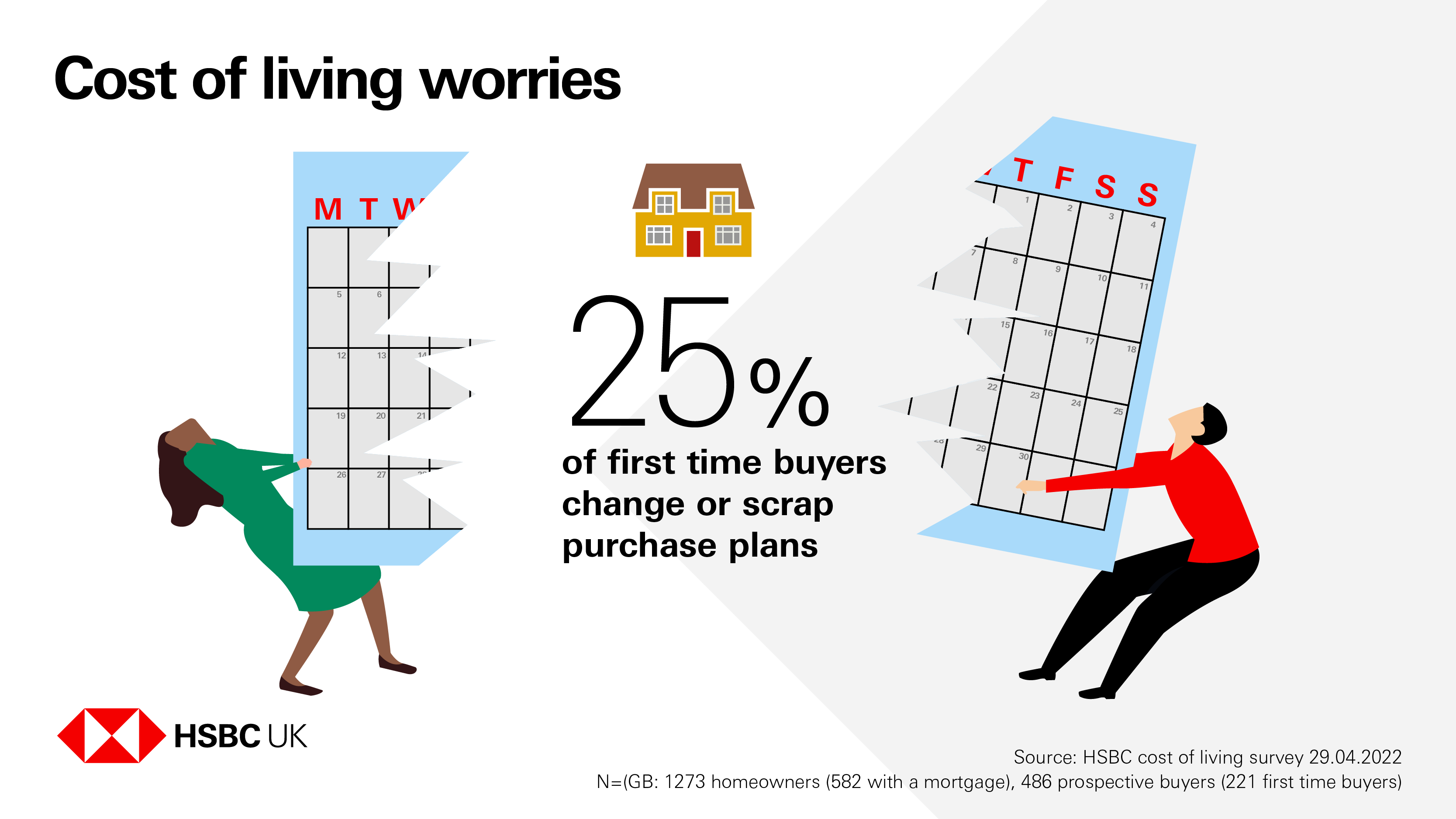

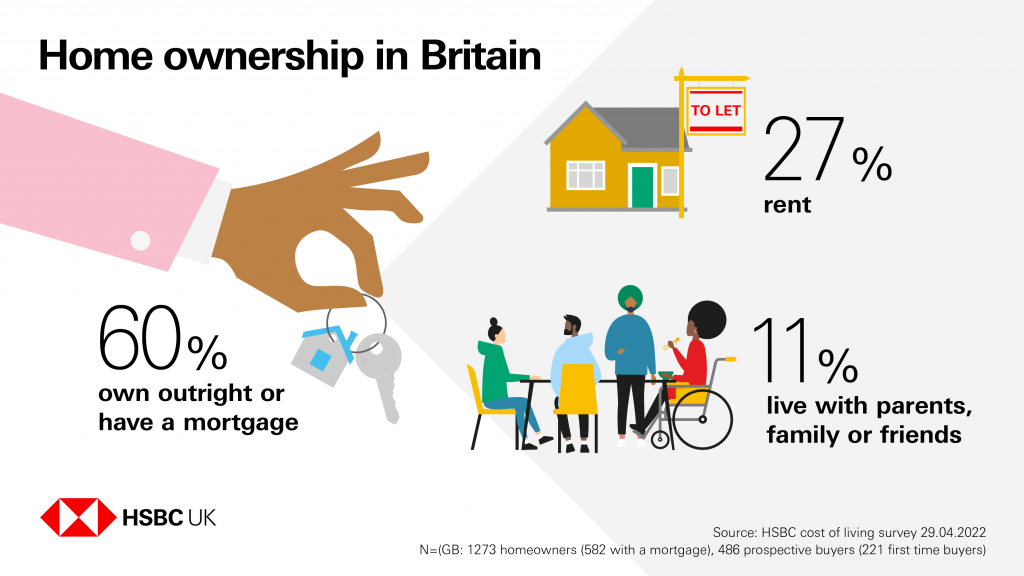

HSBC recently conducted a survey on first time buyers and that showed that 25% of first time buyers have put their plans to purchase a home on hold or stopped searching entirely, with 38% saying the biggest challenge was being a deposit.

This does not surprise me at all as many of us are finding that our spare cash a month is decreasing as the costs have gone up and we are finding it almost impossible to save, without Help getting a mortgage many more will be waiting to get onto the property ladder.

As I said earlier, it is not just first time buyers who are being halted in there plans. 25% of existing homeowners have had to rethink there plan, with 1 in 10 no longer looking to move home. This is where we are sitting, as mentioned above. Whilst we are paying off our mortgage on a good rate, there is no logical sense to increase that mortgage to move and pay it at a rate that will be at least double our current rate.

It is really frustrating as I would love to move and have found a few homes that would have been in budget, in our location. However, in the current climate, it is just not the right time for us and I am having to listen to my head rather than following my heart on this one.

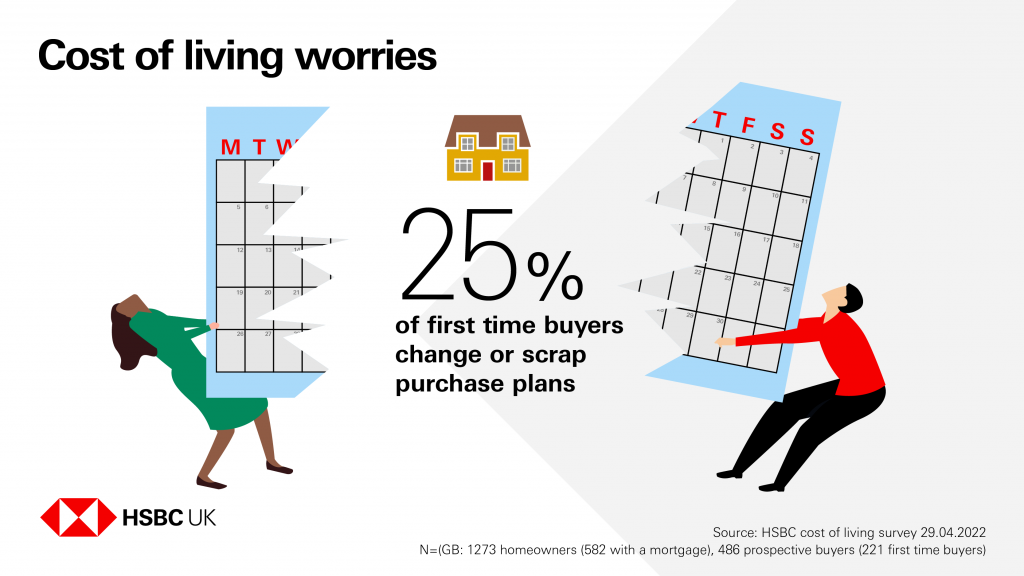

In this survey, it revealed that 60% of people in Britain own their own home, either outright or through a mortgage. I suspect this would have been higher going forward should the interest rates not have rocketed and the size of deposit needed with it. 18% of people surveyed revealed the size of deposit needed was why they had not applied for a mortgage.

I know that this increase should hopefully be for the short term and things will settle down but I can’t help feel a little deflated.

After a few years of hard work we had finally got ourselves into a position where we could think about moving home and creating a little pocket for us out in the countryside and then the countries finances went crazy. Over the next year I just need to look at the positives that we can take from the situation, including getting us into a better financial situation and dealing with what is going on around us better.

We are going to make the most of the time to finish clearing debts and then attacking the mortgage and building a pot to move again when the time is right.

How has the current financial climate affected you and your home? I’d love to hear from you if you are first time buyer or even an existing home owner and what you think of everything that has happened lately.