#Collaborative post

Buy now pay later is a credit form that pretty much every one of us has heard of and it is likely that if you are on a journey to debt-free, part of your debt is something from buy now pay later.

For us, it is the one credit that is always our stumbling block. Usually, because we do not have an emergency fund when something goes breaks such as a washing machine or another essential item, we tend to lean towards the buy now pay later to get us out of a sticky point.

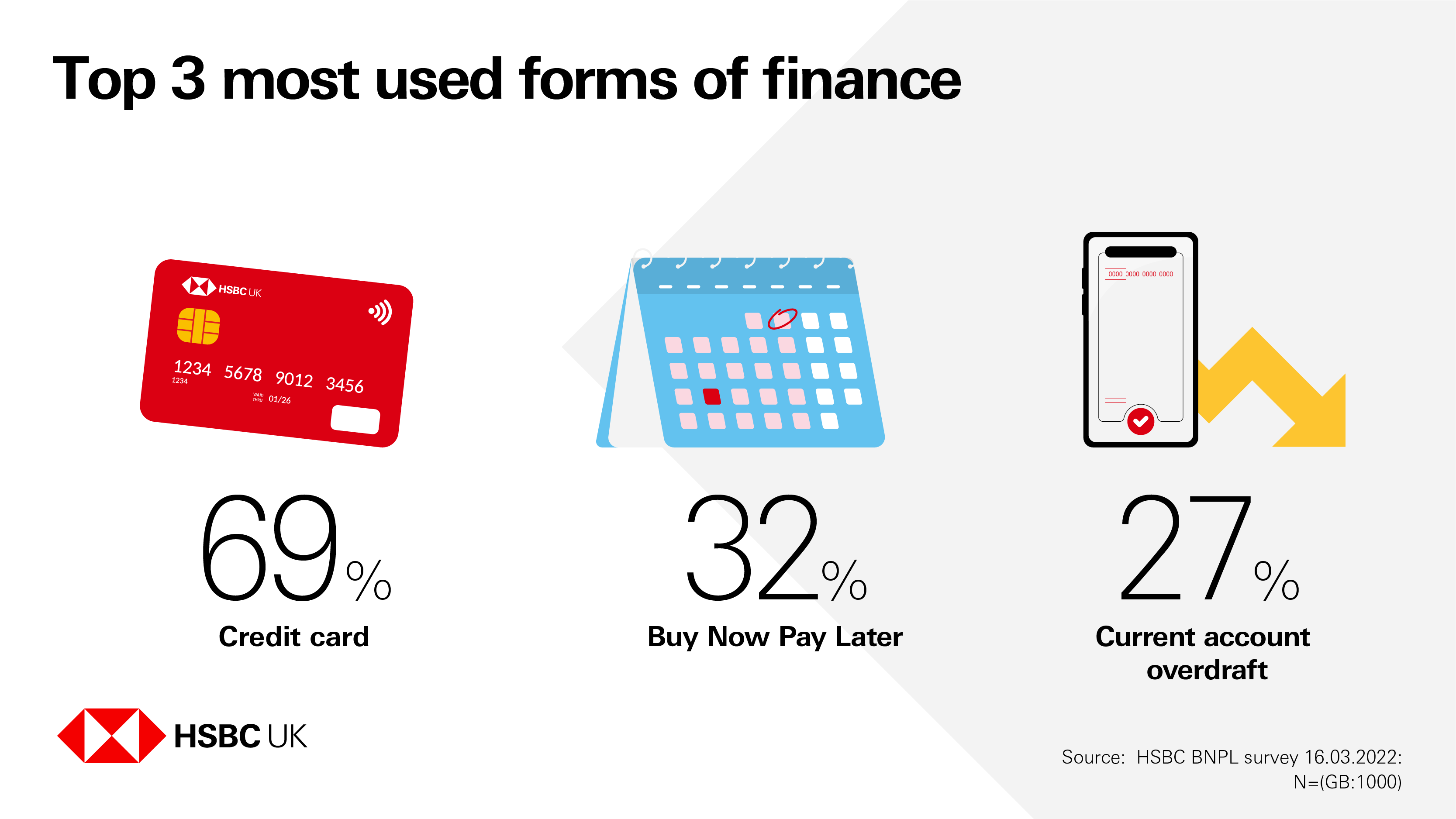

Recent research by HSBC shows that now BNPL (buy now pay later) is the second most-used form of finance behind credit cards with women twice as likely as men to use it.

On the outside, you may not think there is too much to it, you buy it and just make sure you pay it off before it is due. But just take a second to think about it, you have brought something on finance with the plan to pay it off, then something else happens and you are unable to make the payment before interest gets added on the first item. So now you are paying for something monthly, with interest added. The reality of this is you are paying over the odds for something, that if you had taken another route may have not resulted in this situation. This is most likely adding to the strain on your monthly finances too as the payments are likely to be higher than you can afford.

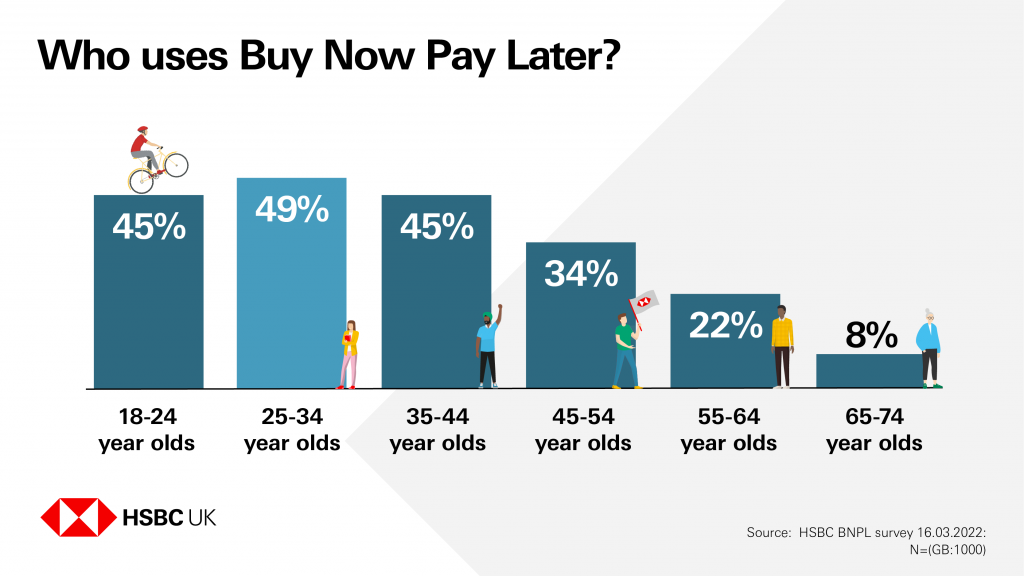

Just under half of 25-34-year-olds have used BNPL in the last year, with 1 in 3 of those who had used it saying they had found out about it being a payment option when making a purchase. This is the one thing that really worries me about it, especially as someone who has used it in the past. It is all too easy to get the credit and then you end up facing difficulties in payment when it becomes due at a later stage.

It seems to be a rise in the options for purchasing on buy now pay later, with it moving away from the traditional items such as furniture and electricals to things such as clothing, food & beverage and games & toys. I do fear that as time goes on, more people will become reliant on BNPL, which in the interim can be a great solution, but it can lead to a false sense of security and financial impacts, later on, can be quite significant.

Even though BNPL is popular, it still is not as popular as credit cards, with 69% of people surveyed still listing credit cards as their preferred form of finance. Concerns we raised by those who have not used buy now pay later, with 62% saying one of the main barriers to use is it appeared to be too easy to get into debt or overspend, and nearly one in three (30%) saying that was the primary factor.

I am not against anyone using BNPL but you just need to be aware of the end outcome of this. For example, if you borrow £500 now, you could be looking at £600 due at the end of the term if the interest is added. Now, the likelihood is you won’t have that to pay over in one go so you would be paying it all. If however though you got a £500 BNPL but paid £42 a month on it, you could clear the debt before the interest is added.

Just speaking from experience though, it is easy to say you are going to pay monthly, but then life happens and it does not always go to plan.

I would love to hear your thoughts on BNPL and if you have ever used it, how you found it.